You would think it would be easy for you to get term life insurance quotes without personal information these days without a hassle.

But the process for obtaining life insurance coverage has been shrouded in confusion and most people won't buy insurance simply because they don't understand it.

Over the years I have assisted thousands of customers with understanding how term life insurance works as well as helping them through the insurance buying process.

Today, I will take you through the back-end of the online insurance buying process and show you how to get term life insurance quotes without personal information the easy and simple way.

How To Get Anonymous Life Insurance Quotes?

You can get anonymous life insurance quotes through Simply Insurance, we don't collect any personal information for a quote. In fact, you can calculate as many life quotes as you would like without having to worry about phone calls from agents.

Get Free Life Insurance Quotes Online Without Personal Info Today!

As you can see below, our quoter doesn't ask for any personal information. We only collect the most essential information to give you a quote which means you don't ever have to worry about us calling you unless you apply for coverage.

Once you decide to move forward you will be sent directly to the insurance company's site and complete your entire application process online; however, agents are available to assist online if you need help.

Can You Get Life Insurance Quotes Without Phone Calls?

If you attempt to obtain a life insurance quote and you are required to put in your name, e-mail address or phone number then you might want to think twice and find a site that doesn't require that type of information just for a quote.

The best way to avoid this problem is to get term life insurance quotes online without personal information and to then buy your life insurance policy 100% online.

Right now there are two types of life insurance products that allow you to do this:

Online Term Life Insurance

A new type of life insurance product that allows you to complete the buying process entirely online without an agent and to get immediate coverage for those who qualify.

According to LIMRA, this year only 15% of consumers stated that they completed and submitted a life insurance application online.

Over the next few years, as millennials start to age, I would expect this number to increase heavily.

Millennials are much more experienced online shoppers than any of the current insurance buying generations and are more likely to buy life insurance online.

And guess what, it get's better:

Companies like Bestow and Haven Life, use proprietary algorithms for their insurance products, you can check out our in-depth reviews as well such as our Ladder Life Insurance Review.

When you combine their algorithm with the Medical Information Bureau and Intelliscript.

They are able to actually start underwriting your application while you are filling it out online for an immediate decision.

Underwriting "in plain English": The process of determining if you are able to get insurance.

These products, at the moment, are geared toward people who have average to excellent health and are a part of the millennial age group. Online Term Life Insurance gives you coverage up to $2,000,000 and at times, can offer even lower rates than companies that require a medical exam.

Simplified Issue Life Insurance

Simplified Issue products and can normally get you an answer or approval within 24 to 48 hours. You are normally acceptable with below average health and coverage amounts usually, will go up to $1,500,000.

They normally have very few health questions and allow for an e-signature process to submit your application. You do not need to talk with an agent and you also have the ability to sign up 24 hours a Day 7 Days a Week.

There is no extra cost for buying this type of product either.

How To Apply For Simplified Issue Life Insurance?

While there are now several simplified issue life insurance companies to choose from, we haven't found any better than Haven, Ladder, Bestow, Ethos & AIG.

These companies have all but mastered the process of online and no exam life insurance.

How Do So Many Agents Get Your Personal Info?

You’re all set and you have decided that you want a term life policy for 20 years and you are ready to find the best quotes from some great companies.

You type “term life insurance quote” into your search browser and you check out a few results.

Once you arrive to the homepage of a result that grabbed your attention, you fill out the required form to get your quote.

Once you click the button to go to the next step expecting to see some life quotes guess what, there are no quotes.

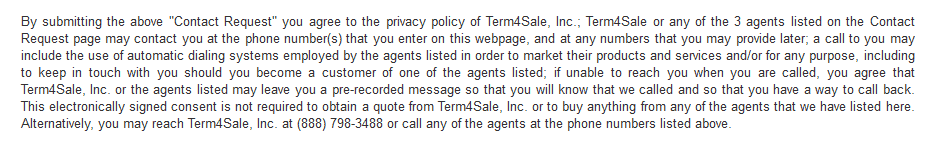

Just a message that says “Our agent will be contacting you soon”, bummer right? In fact, you probably missed their disclaimer that usually looks something like from the company below.

Image taken from Term4Sale.com

Image taken from Term4Sale.comThis means that 90% of the time when you think you are about to get a quote you have not only given the company the right to call you, but also automated systems and many agents.

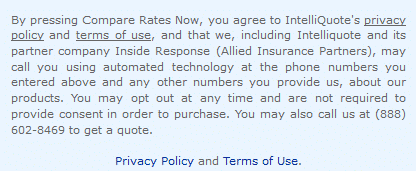

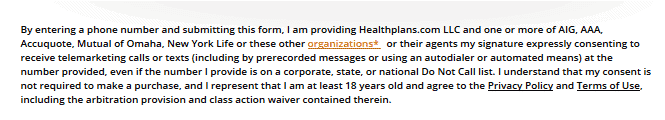

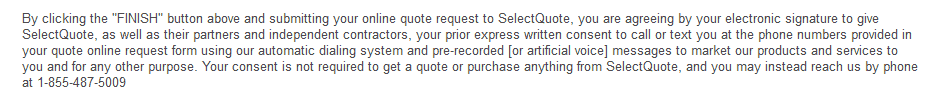

To be frank, most of all the places you want to get a quote online from has the same language, see below for 3 more sites:

Image taken from Intelliquote.com

image taken from Lifeplans.com

Image taken from Selectquote.com

So let’s say you have visited the above 4 sites and you are trying to get a quote so that you can get covered.

Well, this is the core of the dirty phone secret and where all your problems will start.

Agents Buy Your Information As A Lead!

Let’s go even deeper into this:

The way this process works is that a majority of these websites are a “Front” for Insurance Lead Vendors.

This means they don’t even actually sell life insurance.

What they do sell, however, is your information and your interest in getting covered.

When you look at sites like NetQuote and Insuranceleads.com they are the actual companies that own the websites.

When you put your information in one of their forms, you have actually put it into a huge database.

And an Insurance Agent, like myself, is ready to pay for, and compete for your attention.

It gets worse:

Your information was sold and now that you are in the database, you will be tasked by each Insurance Lead Vendor as a specific type of lead.

Traditionally you will be a Shared Lead and there will normally be a Lead Cap associated with your information as well.

A lead cap indicates the largest number of times a shared sales lead can be sold.

Shared Lead "in plain English": A lead that is sold to more than one insurance agent.

For example, a lead cap of 5 indicates that a lead may be sold up to five different times. It’s the potential largest number of times a lead can be sold.

Keep In mind that leads will not necessarily be sold that many times if there are not enough agents to buy the leads.

Some lead generators sell leads with a lead cap of 8, 9 or even 10. So now you can see where this is going to go and how calls can start to add up.

You Just Opted-In For 100 Agents To Call You

So far, you have taken all the right steps, you had a life event that triggered your need for life insurance.

You went online and did your research to find out exactly what type of life insurance you need.

You researched a few companies and then you filled in your information to get some quotes.

Then it starts, you went to 10 websites and requested a quote from each one.

A 2016 Study by LIMRA and Life Happens found that 50% of online shoppers went to a quoting engine website, typically once they had a good idea of what they wanted to buy.

These sites have each sold your information 10 times as a shared lead. Each agent has paid anywhere from $8.00 to $15.00 for your information and they all want to sell you something.

In the insurance industry, each agency has a follow-up goal for agents. For me, I was told to call you within 30 Seconds of receiving your information and to continue to follow up daily.

This means within the first 30 Seconds you probably have missed several calls and did not pay it any mind. Within the next day, all your information would have been sold to the max amount of agents

The Bottom Line?

Your phone will not stop ringing for probably a whole 2 months. These calls won’t stop even after you have made a purchasing decision.

There have been several instances where I reached out to an old lead via email, only to find out that the calls were so overbearing, that the client changed their phone number.

Most of my clients were heartbroken because the phone numbers had stayed with them most of their life. They didn’t want to give their number up but had no choice since they couldn’t stop the calls.

It’s really easy to think you can just add them to the do not call list, but one agent can call you from 3 different numbers. Lifehacker.com has even created a post about how to get rid of telemarketers and it isn’t always an easy task.

LIFE INSURANCE WHERE YOU LIVE

No Exam Life insurance by state.

With a No Exam Life Insurance policy you can take care of your family the right way.

Should anything happen to you, you'll want to leave your loved ones a financial nest egg for their wellbeing. Click on your state to find out more.

Get Life Insurance Quotes With No Phone Calls

At this point, you’ve learned a major secret that most agents don’t want you to know about when getting term life insurance quotes without personal information.

With any of the above processes, you are able to have a much simpler and easier insurance buying experience.

You don't have to worry about being called by agents because your application will be submitted directly to the insurance carrier for underwriting and approval.

As we state earlier, you can get a life insurance quote and get covered online instantly without getting hounded by agents and at your own pace.

Frequently Asked Questions

Which is better term or whole life insurance?

Term life insurance will be the best product for almost 90% of people looking for it. It has the lowest premiums and is very easy to understand; you get a specific death benefit, for a specific term length, for a set price.

How do I get a life insurance policy?

The best way to get a life insurance policy is by shopping online. There is no faster way to buy life insurance, and in the last few years, the process has gotten easier.

What happens to term life insurance if you don't die?

If you don't die before your term policy ends, you have a few options. You can either renew the policy at a higher rate, convert the policy into a whole life policy, or let the policy end.

How much is term life insurance for a 50 year old?

The cost of term life insurance for a 50 year old will depend on a few factors; however, a $250,000 20 year term policy for a woman in excellent health with no exam would cost around $26.42 per month.