Our Verdict

4.7

Ladder Life is an excellent option for purchasing large amounts of insurance fast with the opportunity to change coverage as your life changes.

However, they don't seem to offer any additional policy riders, and don't do a great job at explaining the process with video.

This is why I put this Ladder Life Insurance Review together.

Pros

Cons

When I became a life insurance agent, there was no way you could get life insurance quotes without an agent calling you.

In the age of Amazon and Baidu, everything is going online, and life insurance is just now catching up.

With everything I know about term life insurance, it still took me 3 weeks to get a life insurance approval decision when I decided to get a few term life quotes and get covered.

During those 3 weeks, I had to go pick up my medical records and continuously follow up with the underwriter.

Had I waited for my doctor's office to send in my medical records the decision would have taken much longer.

In this review today, I am going to show you how Ladder Life's Laddering process works, and why it's one of the best ways to buy term life insurance online.

Who Is Ladder Life Insurance?

Ladder Life Insurance is one of the best life insurance companies around and a digital insurance agency who has partnered with Fidelity Security Life Insurance Company & Hannover Re.

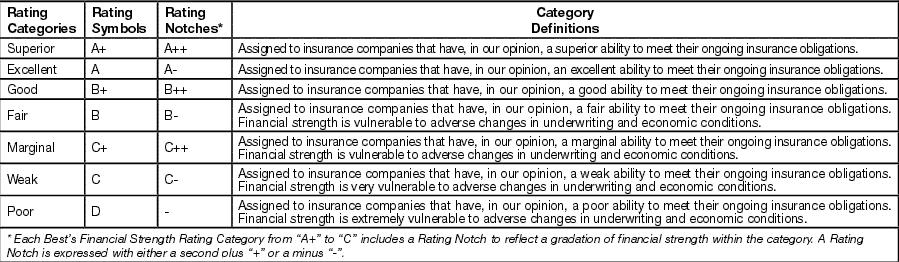

Fidelity Security Life has been around since 1969 and has an A.M. Best Rating of (A- Excellent).

And all of the policies are reinsured and backed by Hannover Re who has an A.M. Best Rating of A+ (Superior).

This is an important factor because when it comes to life insurance, you need to know that you can rely on an insurance company and that they are financially sound.

I have put their company disclosure in a quote block so that you can better view it.

*Disclosure - Ladder has partnered with Fidelity Security Life Insurance Company, which has been rated A- (Excellent), based on an analysis of financial position and operating performance by A.M. Best Company, an independent analyst of the insurance industry. All Ladder policies are reinsured by Hannover Life Reassurance Company of America, which has ratings from Standard & Poor's AA- (Very Strong) and A.M. Best A+ (Superior).

Why Should You Care About A.M. Best?

I like to think of A.M. Best like the JD Power of the insurance industry, they have been around for over 117 years.

Claims Paying Ability "in plain English": A Life Insurance Company's ability to pay out on a policy.

They rate companies based mainly on their financial strength, which can be an indicator or claims-paying ability.

What Makes Ladder Life Different?

What makes Ladder Life so different is that they are changing the concept of how you manage your life insurance coverage and how you purchase it:

Ladder Life is one of the first companies that offer the ability to apply for term life insurance up to $8,000,000 entirely online and without the need to consult an agent.

Their system can underwrite you while you are completing your online application for an Instant Decision.

They have also created a process they call Laddering which allows a customer to either Ladder Up their coverage or Ladder Down their coverage.

For qualified, healthy individuals they will even offer immediate coverage.

Laddering Your Life Insurance Policy

Ladder Life is taking the life insurance and turning it on its head.

They have created a process they like to call Dynamic Life Insurance.

Ladder has streamlined your ability to change your life insurance coverage based on your current life events.

Once your initial coverage is in place, you can either "Ladder Up" or your coverage or "Ladder Down" your coverage.

Laddering Up Your Coverage Easily:

Life changing events are the number one reason that people will need to make changes to their insurance plan.

This is very true when it comes to Laddering up your coverage.

For example:

Let's say you started with $100,000 in life insurance for $18.00/month. You get married, and now all of a sudden $100,000 isn't enough coverage.

With Ladder Life, you get a quote for let's say an additional $150,000 in coverage for an additional $11.00/month.

Ladder would quote you what the additional premium would be, get your exam completed if one is needed, and your policy would change from $100,000 in coverage to $250,000 in coverage.

Your new premium would be $29.00/month, and you would have $250,000 in coverage.

The reason this is awesome is that most companies would require you to cancel your previous policy and start all over from the beginning.

If you were to have a baby or purchase a new home, you start to get the picture of how many times you might need to add more coverage.

Ladder Life Makes it a smooth transition.

Laddering Down Your Coverage For Savings:

Let's Keep the same example from above. However, let's say things are going in reverse.

Your nest egg is growing, you are paying down your mortgage, and your kids are getting older.

Ladder Life is going to give us the option to be able to cut your costs tremendously by allowing us to Ladder Down your coverage for savings, all at no charge.

The way it works is that your payments will decrease by the same percentage as your coverage does.

If you decrease your coverage by 10%, your premiums will decrease by 10%. You can do this on a monthly basis.

If you use this option, just think about the savings.

If you end up with $2,000,000 in coverage for let's say $100.00/month and decide to decrease your coverage by 8%/month.

Based on the chart below, in the first year alone you would have saved $62.32/month.

Without making any additional changes that's a saving of $13,564 over 30 Years.

Laddering Down Chart

Month | Monthly Premium | Percentage | Savings |

|---|---|---|---|

January | $100.00 | 8% | $8.00 |

February | $92.00 | 8% | $7.36 |

March | $84.64 | 8% | $6.77 |

April | $77.87 | 8% | $6.23 |

May | $71.64 | 8% | $5.73 |

June | $65.91 | 8% | $5.27 |

July | $60.64 | 8% | $4.85 |

August | $55.78 | 8% | $4.46 |

September | $51.32 | 8% | $4.11 |

October | $47.22 | 8% | $3.78 |

November | $43.44 | 8% | $3.48 |

December | $39.96 | 8% | $3.20 |

Total Savings: | Cell | Cell | $62.23/month |

Ending Coverage: | $735,000.00 Remaining | ||

You also would still have around $735,000.00 in life insurance remaining.

This is a new way to look at and treat life insurance, and I think others will soon follow suit.

INSURANCE WHERE YOU LIVE

Life insurance by state.

" data-uw-styling-context="true">Is It Really A 5 Minute Decision?

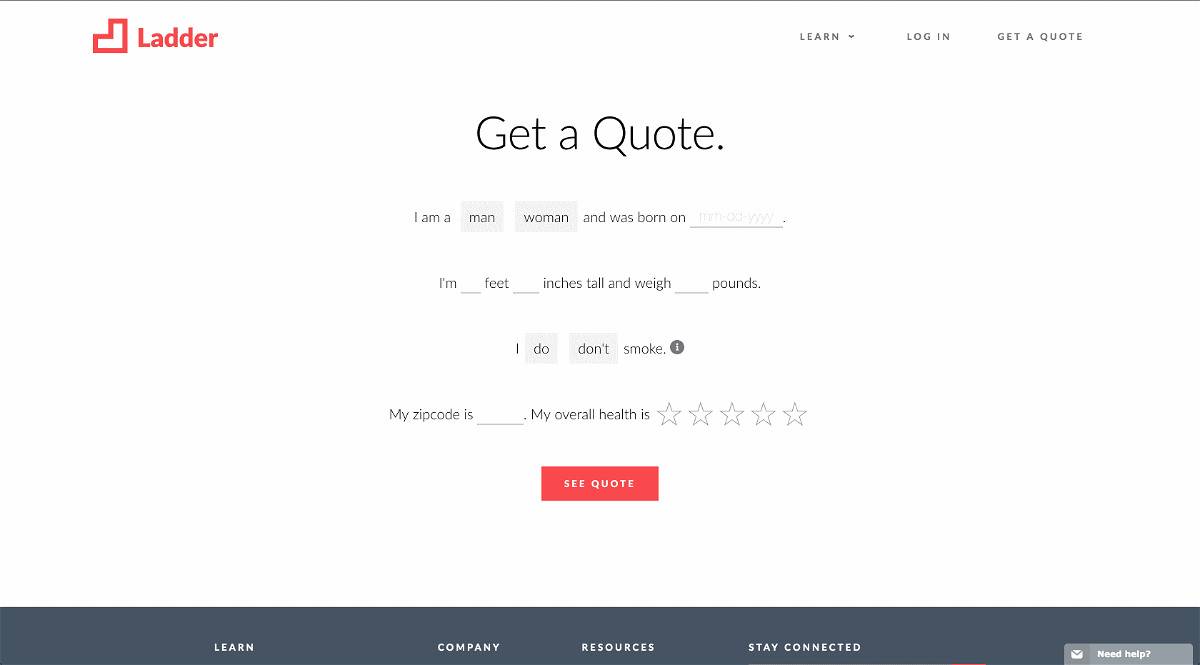

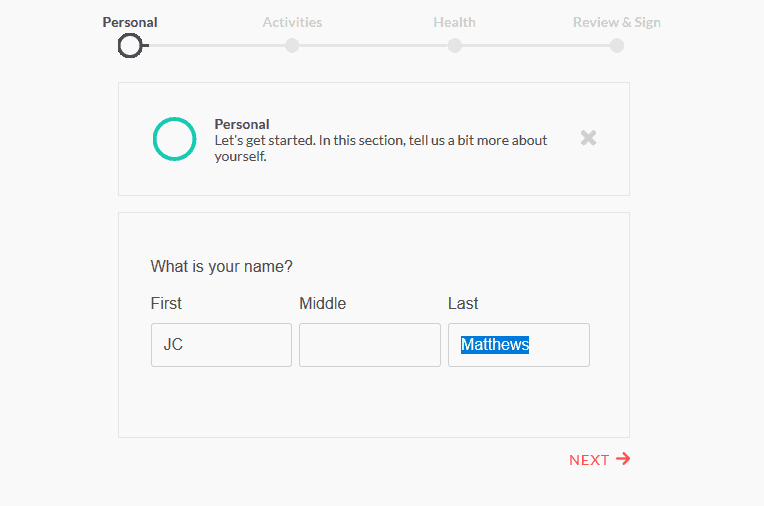

Getting started is pretty simple, you are asked a few questions to get your initial quote:

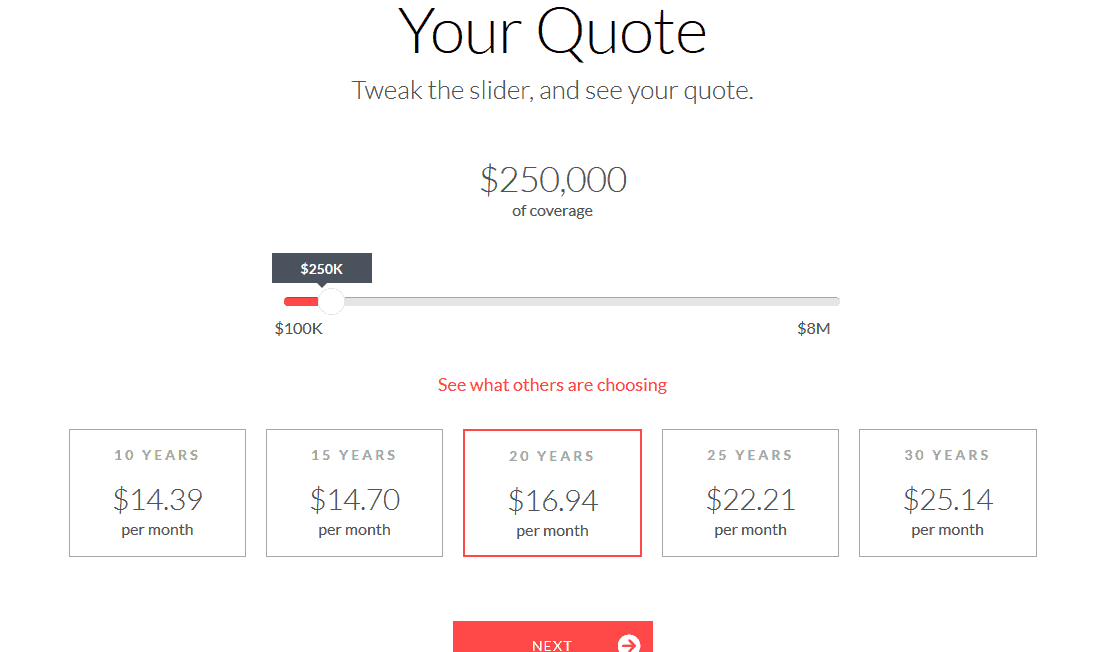

Once you insert your information and click the "See Quote" button you are sent to a review page to see your results:

Ladder takes a bit of a different approach to their application.

They do a complete verification of your personal information on the front end; I prefer this method.

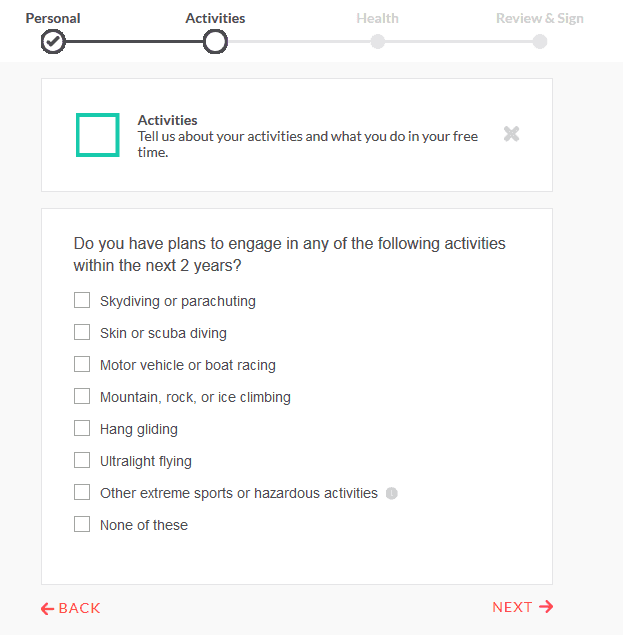

It took me about 2 minutes to both read and answer the personal questions. The next part was Activities:

Unlike other carriers, at this point in the application, they ask about tobacco use in the last three years or marijuana during the previous 12 months.

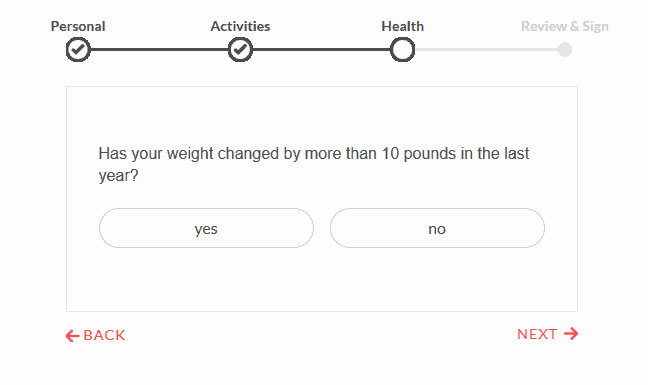

The next part was all about your current health situation:

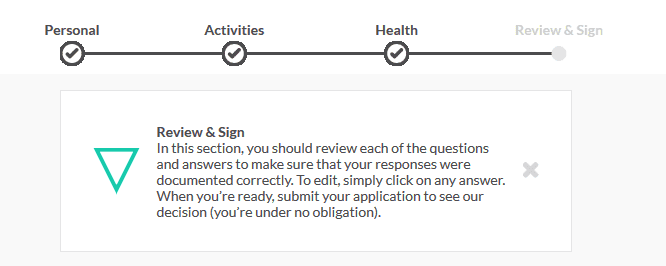

After you knock out your health questions, you are sent to the section to review and sign your application.

I can honestly say that if you know all of your personal information like your social, drivers license and primary doctor's information then yes; you are easily looking at around 5 minutes for a decision.

Up To $8,000,000 In Life Insurance

Ladder Life Insurance has really created a great option here by offering up to 8 Million Dollars in life insurance coverage.

To some, it might seem like a bit extreme; however, it's all about annual income, and some people need this amount of coverage.

The reason I am excited by this is that Ladder Life is going to eventually be able to replace the long process of financial underwriting with better and faster technology.

Also, this is the MOST any insurance carrier is offering in a consumer-facing product.

If you need more than $1,000,000 in life insurance, then Ladder Life is definitely the place you should start.

Ladder Life's Rates: How Do They Compare?

Ladder Life's monthly rates are based on a male wanting $250,000 in coverage for 20 years. If you look below, you can see that they have some very competitive rates:

Ladder Term Life Insurance Rate Chart

Age | Monthly Rate |

|---|---|

25 | $12.79 |

30 | $12.93 |

35 | $15.25 |

40 | $21.25 |

45 | $31.67 |

50 | $46.67 |

Ladder Life's Availability & Policy Options

To qualify for the Ladder Term life insurance policy, you must:

30 Day Free Look Period

Like with all of the best fully underwritten life insurance companies, you are given time to review the policy and make sure that it is a fit for you and your family.

Think of it as a 30 Day Guarantee.

If you decide against the policy within that 30-day window, you can cancel it and receive a full refund.

Taking Action

I know our Ladder Life insurance review is one of the longer ones out there. However, I wanted to make sure that I gave as much detail as possible.

If you have been holding off on buying life insurance for any reason, there is no better time to get covered. Just click here or on any of the above buttons to get an instant life insurance quote and coverage from Ladder.

In This article