When it's time to buy a home, the one thing most of us are unaware of and unprepared for is the idea of needing homeowners insurance to close on a home.

According to a recent study conducted by Hippo, 73% of people do absolutely no research before they buy home insurance.

And with 95% of homeowners in the U.S. having homeowner’s insurance, this must mean there are a ton of Americans that don't have the best policy for their home.

Our Hippo Home Insurance Reviews:

Hippo is hands-down, the best way to buy homeowners insurance online and avoid the traditional 3 to 5 day application process. They are backed by TOPA Insurance with An A- Rating From A.M. Best.

In this review today I am going to show you how Hippo's process works, and why using them is the best way to buy homeowners insurance online and fast.

Who Is Hippo Insurance?

Hippo is what I like to call a NewTech Insurance Company.

A NewTech Insurance Company is an insurance company that creates a new buying process for their industry and sets a new standard.

This is exactly what they are doing.

They are backed by TOPA Insurance who has an A- (Excellent) rating from A.M. Best.

This is an important factor because when it comes to insurance you need to know that you can rely on an insurance company for their financial strength and longevity.

What Makes Hippo Insurance Different?

What makes Hippo so different is that they are changing the way homeowners insurance is purchased, and what benefits should come standard on the average homeowners insurance policy.

Hippo's home insurance is introducing a much easier, faster and seamless process by having a 100% online process.

You can get quotes within 60 seconds and apply online in minutes, and because everything is web based, on average, their premiums are coming in at around 25% cheaper than other companies.

As I stated above, they are offering a more modern coverage by adding things like home electronics and smart appliances to their plans.

They also offer enhanced coverage for home offices and coverage for things like water backflow and service lines.

THE SIMPLY INSURANCE WAY

Home Insurance made easy.

Agents not required.

Get quotes and sign up online without talking to an agent. But, we are here if you need us.

Unbiased, expert advice.

Get unbiased insurance education from licensed experts and also avoid dodgy sales calls.

Coverage in minutes.

You can get Home insurance coverage within minutes of getting your quotes and applying.

Pros And Cons Of Hippo Homeowners Insurance

Below is a list of some pros and cons of Hippo's homeowners insurance plan.

Hippo Insurance Review - The Pros

Hippo Review - The Cons

It's easy to see, the pros outweigh the cons and honestly, isn't that what you want in a home insurance company?

What Does Hippo Homeowners Insurance Cover?

Coverage For Your Home

It will cover your home and any secondary structures on your property. It does not include the coverage for your personal property or personal liability.

Rebuilding Cost - Just a general estimate of how much it would cost to rebuild your home and any secondary structures on your property in the event of total damage.

Extended Replacement Cost - This added protection increases your standard home coverage by an additional 25%-50% (depending on which Hippo insurance plan you select) in case the cost of rebuilding your home is higher than expected.

Depreciated Value (DV) - Depending on the type of plan you choose, If something in your plan - like your roof or a personal belonging - is insured for its Depreciated Value, any claims will be calculated by determining how much you originally paid for that item, how long you’ve owned it, and how much the item is worth today as a result of depreciation.

Replacement Cost (RC) - When something in your plan is insured for its Replacement Cost, a covered claim would be reimbursed for the cost of replacing that item as of today, minus your policy deductible.

Insurance for Roof Repairs - In the event of damage, your roof may either be insured for its Depreciated Value (based on its age) or its Replacement Cost (the cost of repairing or replacing it today). This valuation type is automatically determined based on the roof’s age and materials.

Coverage For Your Belongings

This is the coverage that will cover some of your personal property both inside and in certain instances, outside of your home.

When claims are made for covered items, your insurance pays either the replacement value or depreciated value of the belongings, depending on your selected Hippo plan.

The amount of coverage paid out may vary depending on type of item, location of item (in vs. out of home) and the specific type of peril.

Hippo’s Our Best Value and Expanded Protection plans provide Replacement Cost Coverage, which pays you what it would cost to purchase similar new items at current retail prices.

The Essentials plan from Hippo provides Actual Cash Value coverage, meaning, the depreciated value of your possessions at the time of the loss (not when you bought them).

Coverage For Your Liability

This is the insurance that covers certain instances of bodily injury, personal injury (emotional or other non-physical damages), medical expenses, and property damage sustained by others for which you or your family members are legally responsible.

Additional coverage included in all Hippo plans

The best thing about a Hippo Insurance policy is that it comes with all types of additional coverage, check out what else is covered below:

Loss of Use - Will cover you for any extra living expenses while your home is being repaired; things like food, hotels and storage.

Ordinance Coverage - This will cover you if an ordinance change in your area increases the cost of construction when you need to rebuild part of your home.

Water Backup - Covers any damages caused by the backup and overflow of water from drains or sewers.

Jewelry & Watches - Covers for loss by theft of Jewelry, Watches, Furs, Precious and Semi-Precious Stones, coverage amount depends on the type of policy you purchase.

Enhanced coverage also included in all Hippo plans

But Wait... There's more, I know it seems gimmicky, but Hippo has even more enhanced coverage that's also included in all of their plans:

Equipment Breakdown - Covers the cost of repair or replacement for pretty much everything in your home that uses electric power, in the event of electrical or mechanical breakdown.

This includes things like your:

- Washer & Dryer

- Kitchen Appliances

- Water Heaters

- Computers & TVs

The Equipment breakdown coverage protects up to $100,000 and the deductible is only $500, which is less than the standard deductible for other types of claims.

Domestic Workers - This coverage protects you if a residence employee (like a nanny, gardener or babysitter) is injured on your property.

Home Office - Covers home office equipment such as computers and printers for up to $10,000. If you work from home, this is an awesome benefit.

Computers - Laptop & desktop computers and related storage devices covered up to $10,000.

Extra Water Backup - This doubles your standard water backup protection, covering up to $15,000 for damages caused by backup and overflow of water (Included in Hippo’s Extended Protection plan).

Mortgage Payment Protection - In the event that your home becomes uninhabitable, this coverage provides up to $1,500 a month, for up to 12 months, toward your mortgage payments (This coverage is included in Hippo’s Our Best Value and Extended Protection plans).

Extra Jewelry & Watches - Increases coverage up from $2,000 to $5,000 for loss by theft of Jewelry, Watches, Furs, Precious and Semi-Precious Stones (Included in Hippo’s Extended Protection plan).

3 Different Types of Deductibles

Your policy is going to have 3 different deductibles, this is the amount of money you will need to pay for an eligible claim before Hippo starts to pay.

We detail them below:

General

Applies to eligible claims that are not a direct result of wind, hail or a named hurricane. Also known as "All Peril Deductible".

Wind Or Hail

Applies to eligible claims that are the direct result of wind or hail damage.

Hurricane

Applies to eligible claims that are the direct result of a named hurricane at the time the loss occurred.

Keep in mind that all of the above deductibles will have a different amount so be sure to remember what amount you will need to cover based on how the loss occurred.

Rental Property & Vacation Home Protection

If Hippo insures your primary residence, they can also insure your secondary or vacation home.

This is awesome if you are renting out a condo you are still covered.

The Three Hippo Plans & What They Cover

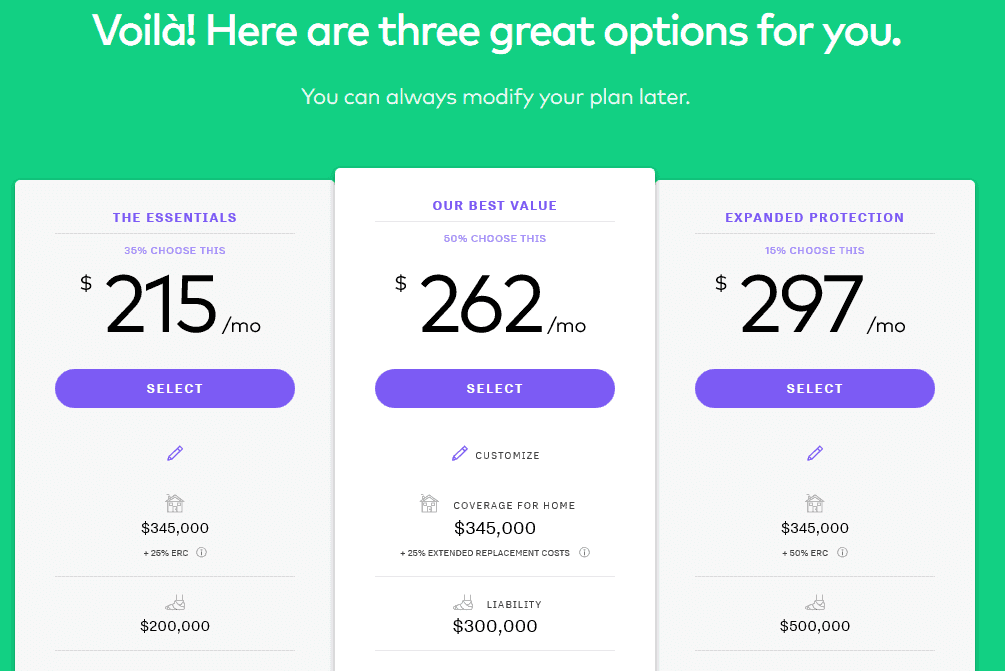

The devil really is in the details when it comes to homeowners insurance, and Hippo Insurance has made it much simpler with its 3 different policy options.

These plans all range in different levels of protection and give you the ability to fit coverage into your budget.

Anything is better than nothing when it comes to insurance, so at the least, buy what you can afford.

Below is an image of how the quotes will be displayed as well as more detailed information about how each plan works:

The Essentials

The Essentials plan is just that, all of the essentials, Hippo shows that around 35% of people usually purchase this plan.

This plan will have the highest deductibles, and most of the benefits will cover only the actual current value of an item when it's lost, not how much it costs to replace it.

It will also have lower coverage amounts for most of the benefits including things like liability and medical.

This is the only plan out of the 3 that Does Not have mortgage payment protection.

In general this policy will cover:

As you can see... The Essentials Plan is packed with a ton of value and can stand up against the best offerings of other companies.

Our Best Value

The Our Best Value plan is going to give you the best of both worlds in terms of coverage and premium, Hippo shows that around 50% of people usually purchase this plan.

This plan is going to include all of the benefits of "The Essentials" plan but give you more benefits for all of your coverage options like Liability and Medical.

You are also going to see lower deductibles for this plan.

With this plan your personal property is covered for Replacement Cost, this means if you have a loss, Hippo will cover what it will cost to replace the item, not what it's current value is.

In general this policy will cover:

- Everything In The Essentials Plan

- Mortgage Payment Protection

- Replacement Cost Coverage

Expanded Protection

The Expanded Protection plan is going to be the most expensive option, but has the most coverage available.

Hippo shows that only around 15% of people usually purchase this plan.

This plan is going to include all of the benefits of "The Essentials" plan and the maximum amount of benefits for all of your coverage options and the lowest deductibles.

Your benefits are also covered for Replacement Cost, this means if you have a loss, Hippo will cover what it will cost to replace the item, not what it's current value is.

In general this policy will cover:

- Everything In The Essentials Plan

- Everything In The Our Best Value Plan

- The Highest Limits & Lowest Deductibles

A Free (Roost Water Leak Sensor) With Every Policy

Don't you love the word Free? I know I do...

You are already saving money if you get a policy through Hippo.

These sensors cost $50.00 each and will be yours for free when you purchase your policy.

Just another awesome benefit that almost no other company is offering.

According to Roost, you can outsmart water with their smart water leak and freeze detector.

The way it works is that you place it anywhere the potential for flooding or leaking exists like:

- Under Fish Tanks

- Under Sinks

- Near Water Heaters

- In Basements

- Under Washing Machines

- Near Dishwashers And Refrigerators

- Near Plumbing And Toilets

If it senses a water leak, it sends alerts to your smartphone.

It also silently connects to home Wi-Fi in minutes and has a 3-year battery life (AAA batteries are even included):

This is a great product for your home or smart home, even if you don't get your homeowners through Hippo, you can read all about the product here in even more detail.

What Does Hippo Insurance Not Cover?

Hippo Insurance offers a very comprehensive plan; however, there are a few things that Hippo Does NOT cover, like:

- Earthquake Damage

- Flood damage

- Sinkhole Damage (In certain states)

- Landslides & Mudflow Damage

When you are going through the application process, Hippo has a live chat area for you to ask any questions that you may have.

The representative that I chatted with was very knowledgeable and can answer any state specific questions.

You also should be mindful of what things will be covered by other types of insurance like car insurance, life insurance, travel insurance or health insurance because if your home insurance companies wont cover it, the others might.

HOME INSURANCE WHERE YOU LIVE

Home insurance by state.

Protecting your new home should be a top priority.

Click on your state to get a free home insurance quote and make sure that you're fully protected.

How Much Does Hippo Coverage Cost?

The average cost of homeowners insurance is about $109.00 per month. However, the main driver of your premium is the cost it would take to rebuild your home in case of a disaster.

This is based on the materials used to build your home, number of rooms, number of stories, and many other factors. The location of your home and your personal history with home or renters insurance claims are also taken into account.

Hippo has made it very easy to compare quotes and review insurance rates online. The best way to find out your cost is to check out our home insurance calculator.

Hippo Insurance Review & Enrollment (Video)

Hippo Homeowners Insurance Availability & Options

There are a few things to take note of with a Hippo policy:

Hippo Condo Insurance Review

Your Hippo Condo Insurance quote can still be completed in about 30 to 60 seconds and have the policy finalized within 4 minutes.

This is awesome for anyone who wants to insure multiple homes with them or for anyone who wants the same great product and speed for their condo.

Some special benefits about their condo insurance is that it is available for condo owners and condos rented to others. You can add up to $15,000 for water backup coverage.

And get this:

$5,000 for Computer coverage and Home Office coverage come standard on the policy and can be increased. This policy also has Equipment/Appliance Breakdown coverage for a primary condo or a condo rented to others.

The primary differences between Hippo's home insurance and condo insurance are small. For example, your Condo policy will come with something called Loss Assessment Coverage.

Loss Assessment Coverage would cover the portion that you owe so that you don't have to pay out of pocket for the expense. If the clubhouse burns down, the condo will split the cost to everyone in the condominium.

Your Hippo Condo Insurance quote can still be completed in about 30 to 60 seconds and have the policy finalized within 4 minutes.

This is awesome for anyone who wants to insure multiple homes with them or for anyone who wants the same great product and speed for their condo.

Some special benefits about their condo insurance is that it is available for condo owners and condos rented to others. You can add up to $15,000 for water backup coverage.

And get this:

$5,000 for Computer coverage and Home Office coverage come standard on the policy and can be increased. This policy also has Equipment/Appliance Breakdown coverage for a primary condo or a condo rented to others.

The primary differences between Hippo's home insurance and condo insurance are small. For example, your Condo policy will come with something called Loss Assessment Coverage.

Loss Assessment Coverage would cover the portion that you owe so that you don't have to pay out of pocket for the expense. If the clubhouse burns down, the condo will split the cost to everyone in the condominium.

THE SIMPLY INSURANCE WAY

Home Insurance made easy.

Agents not required.

Get quotes and sign up online without talking to an agent. But, we are here if you need us.

Unbiased, expert advice.

Get unbiased insurance education from licensed experts and also avoid dodgy sales calls.

Coverage in minutes.

You can get Home insurance coverage within minutes of getting your quotes and applying.

Hippo Landlord Insurance

Hippo is now offering landlord insurance for rental properties.

If you purchase your personal homeowners through them and decide to obtain your landlord insurance through them you will get a discount on your Landlord policy.

Their Landlord policy is currently only offered in California but coverage areas will be increasing soon.

Alternatives To Hippo Homeowners Insurance

Your Best alternative to Hippo Insurance is going to be Lemonade. Not only do they offer a 100% online seamless process, but they also give you approval in minutes. You can check out our detailed Lemonade Insurance review here.

Hippo Claims Process

Hippo provides a dedicated claims advocate to all of their customers when they submit a claim.

The advocate will with you to manage your claim related needs and ensure you obtain the best and most effective resolution as quickly as possible.

They will help you with communications with adjusters, service providers and even help book hotels or transportation if necessary.

You have to call in to submit a claim, but hopefully they will add the ability to submit a claim online or via your cell phone in the near future.

There really isn't much information about exactly how the Hippo Claims process works just yet.

To submit a claim, you can call 1-800-886-0318.

Taking Action

No other Hippo Insurance Reviews are as long as mine; however, I wanted to make sure that I gave you as much detail as possible.

If you have been holding off on buying homeowners insurance for any reason, I say give Hippo a shot.

You have nothing to lose, if you decide to cancel the policy before the year is up, your remaining days of coverage will be pro-rated and you will receive a refund based on days remaining.

Just click here or on any of the above buttons to get started.