Our Verdict

4.7

Fabric, which sells life insurance, has positioned itself to be one of the easiest and fastest ways to buy term life insurance online. They offer a no-exam option for some applicants (up to $1,000,000 in coverage—beyond that a health exam is required).

I put this Fabric

Life Insurance Review together to help you see how simple and fast Fabric makes it for you to apply for term life insurance online.

Pros

Cons

Fabric Life is one of the newest contenders in the online term life insurance space and it has come to win.

They have taken the overall process of purchasing life insurance and re-imagined it by building out internal underwriting systems and workbenches.

In this review today I am going to show you how Fabric Life uses its term life insurance product to get you out of the underwriting process fast and to get you covered.

If you aren't familiar with what underwriting is, then check out this ultimate guide to how life insurance works where I explain everything you need to know about life insurance in general.

Fabric’s Life Insurance: Who’s Behind It?

Fabric was created with the idea of bringing financial products for new parents into the modern age and creating a simple experience and an affordable life insurance product.

Their policies are backed by Vantis Life Insurance Company, which has been around since 1942. That amount of time means that they aren’t going anywhere, anytime soon.

That’s a significant factor when choosing which insurance company to deal with; you want to know they will be around when or if you need them.

Right now Vantis Life currently holds an A+ (Superior) Rating for financial security with A.M. Best.

To top it off, Vantis is wholly owned by Penn Mutual, the second-oldest life insurance company in America (est. 1847).

So when it comes to history and stability, Fabric and co has you covered.

THE SIMPLY INSURANCE WAY

Life Insurance made easy.

Agents not required.

Get quotes and sign up online without talking to an agent. But, we are here if you need us.

Unbiased, expert advice.

Get unbiased insurance education from licensed experts and also avoid dodgy sales calls.

Coverage in minutes.

You can get home insurance coverage within minutes of getting your quotes and applying.

Why Should You Care About A.M. Best?

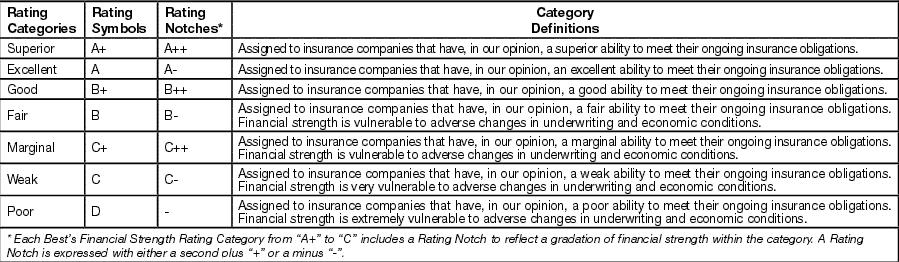

I like to think of A.M. Best like the JD Power of the insurance industry, they have been around for over 117 years.

They rate companies based mainly on their financial strength, which can be an indicator or claims-paying ability.

Claims Paying Ability "in plain English": A Life Insurance Company's ability to pay out on a policy.

What Makes Them Different?

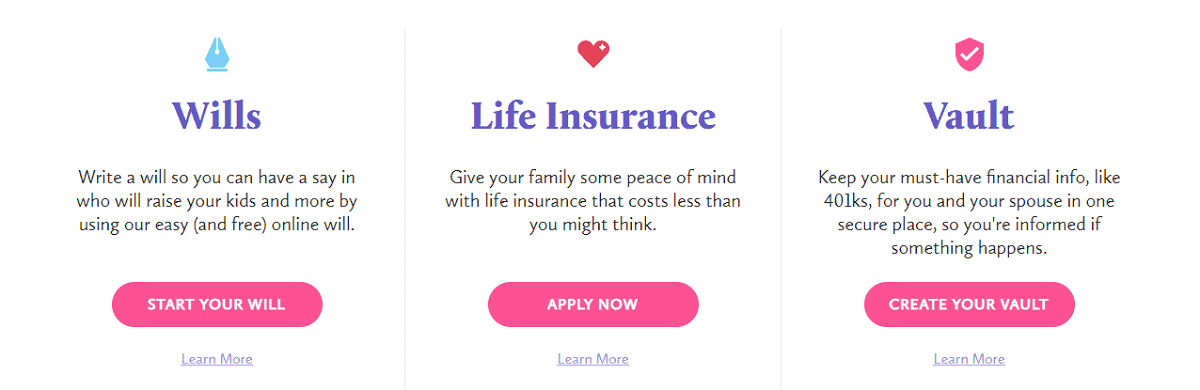

Fabric is looking to give you an entire suite of products surrounding your life insurance, not just a life insurance policy.

As you can see below, they offer free Wills and what they call Vault, where you can keep your financial documents in one secure place to stay informed.

They also have created an in-house underwriting system that allows for more people to be approved for life insurance at an accelerated pace.

They’ll do their best to approve your application immediately through an algorithm.

If that’s not possible, they have underwriters who will look at the file to potentially provide you with a decision right away, as well.

Of course, that isn’t possible for every applicant, so in some cases you may still be required to take a medical exam.

They are also focused 100% on making your buying experience both simple and beautiful. I think those two words sum it up.

INSURANCE WHERE YOU LIVE

Life insurance by state.

">How Does Fabric’s Term Life Insurance Work?

Fabric Premium is a term life product that will pay a lump sum to the beneficiaries in the event of your death.

This term life policy works like any traditional life insurance policy and will cover you for any type of death.

Your death can be accidental, natural or by a terminal illness.

There are some common exclusions that impact coverage, and they’re listed clearly during sign-up for you to review.

(For example, if you commit suicide within the first two years or if you’re dishonest or inaccurate in your application.)

Fabric offers options for up to $5 million in coverage.

If you need $1 million in coverage or less, you might be able to qualify for approval without an exam.

If and when your application for Fabric Premium is approved, you get the option to choose a different term length or coverage amount (note: you can adjust it downward but not upward) with no additional underwriting.

This product offers a 10-, 15-, and 20-year term option and goes from ages 21 to 60 in most states.

They have also built a feature so you can share your term life insurance policy details with your beneficiary directly.

Fabric is an all-around great company with a great life insurance product and they offer awesome benefits you can take advantage of for free, like their online Wills.

Fabric's Life Insurance Rates

These example monthly rates from Fabric are based on a 20-year term policy for both a male and a female wanting $250,000 or $500,000 in coverage.

- fabric Prices For Men

*Rates are based on a 20-Year Term Policy - Non-smoker female with a preferred health rating

Age | $250,000 | $500,000 |

|---|---|---|

21 Years Old | $14.37 | $19.80 |

25 Years Old | $14.37 | $19.80 |

30 Years Old | $14.66 | $20.43 |

35 Years Old | $14.96 | $21.05 |

40 Years Old | $21.35 | $31.70 |

45 Years Old | $27.74 | $42.35 |

Fabric's Term Life Availability & Policy Options:

To qualify for the Fabric’s term life insurance policy, you must:

Other Products From Fabric

In addition to term life insurance, Fabric also offers:

Free Online Will

Whether or not you buy life insurance through Fabric, the company will let you create a last will and testament for free.

You can get it done in five minutes, then they’ll send you a checklist to help you make it legally binding (this can be as easy as simply printing out the document, signing it and getting it witnessed by two people).

Just as term life insurance is very important for helping to protect your family in case the worst happens, outlining your last wishes in a will can be crucial.

Digital Vault

Fabric lets you link your financial accounts and share them with your spouse or partner to help you get on the same page about money.

That also means that if something were to happen to you, your partner would know where to find the necessary accounts.

Even better?

If you get a life insurance policy or create a will through Fabric, those policy details will appear in your “vault,” too.

THE SIMPLY INSURANCE WAY

Life Insurance made easy.

Agents not required.

Get quotes and sign up online without talking to an agent. But, we are here if you need us.

Unbiased, expert advice.

Get unbiased insurance education from licensed experts and also avoid dodgy sales calls.

Coverage in minutes.

You can get home insurance coverage within minutes of getting your quotes and applying.

How To Take Action

I know this review of Fabric’s life insurance is detailed, however, I wanted to make sure that I gave as much information and specifics as possible.

If you have been holding off on getting some type of life insurance for any reason, I say give Fabric Life a chance, especially if you are between 21 and 60.

They have one of the fastest online processes and very affordable rates.

Just click on the button below to get started.

In This article